How To Manage Your Personal Loan Payments?

Are you managing your personal loan payments smartly? If yes, you will repay the loan faster; however, if no, you need to be aware of better ways to ward off penalties and late payment fees. Personal loans are an excellent solution for several working professionals to cater to unforeseen expenses. They are readily available and meet your needs for urgent cash immediately. These loans are unsecured and have higher interest rates over traditional loans that demand collateral for borrowing. Though personal loans do seem to be a simple way out of a financial crisis, managing them is sure a mammoth task!

Lessen the burden of personal loans

Do you want to manage your personal loans in a better way? Given below are some simple tips to help you manage your personal loan payments every month smartly-

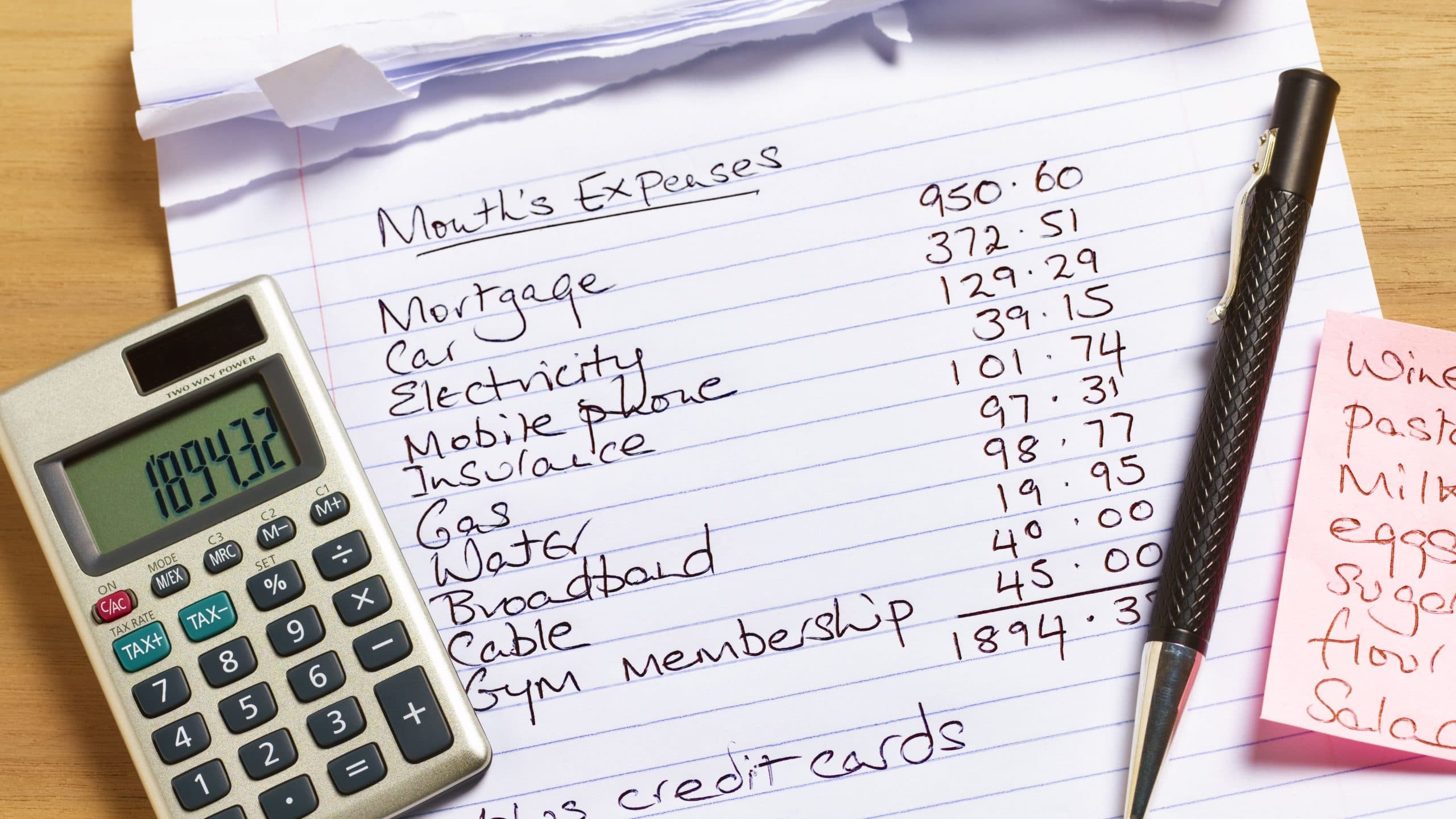

- Create and stick to a monthly budget-Create a budget and take time to list your daily expenses for the month. When you have created a budget, you know how much you spend compared to your income. This budget will help you to plan out your finances for the month and check spending patterns that make you waste money.

- Watch out and keep a tab after you have taken a personal loan– Be alert and make a list of the things you do not need right now. If you are an impulsive buyer, you need to keep a tab of everything you buy, or else you will go out of control. There are some things that you can cut down from your budget. Make a list of them. These items can be eating out at restaurants, parties, etc. You can stop using a cab and commute on public transport to save costs. This reduces your expenses, and you can save more.

- Calculate the monthly loan repayments– Sort out the repayment basics of your personal loan. You need to analyze the amount you have taken against your finances. Check and calculate how fast you can pay off your personal loan to become debt-free. You may seek professional help from financial advisors for guidance. Again, there are free online EMI calculators to help you get an estimate on how fast you can pay off your current loan. You just need to fill in your details of the personal loan to get the results from the comforts of any place.

- Repay on time– Never miss out on any of your monthly repayments. If you don’t repay in time, monthly installments stack up in a pile, and paying them off will be difficult. If you miss your monthly payments, this affects your credit score adversely. To avoid missing out on monthly payments, reduce your expenses, and use the money saved on paying off your personal loan.

- Make loan repayments your first priority-Stay disciplined with your repayments like your monthly expenses. Do not waste money on big purchases you do not need right now. Wait till you have repaid the loan to buy it.

- Set payment reminders every month – Set monthly reminders for paying out personal loan installments in time. These reminders will ensure you have enough balance in the bank for the payments to be deducted on time. Moreover, in case you do not have sufficient bank balance when you receive the reminder, you can always arrange for cash and ensure the installment repayments are never missed.

When you take out a personal loan, you should never feel overwhelmed when it comes to debt management. Personal loans have benefits if they are managed smartly. Small and straightforward lifestyle changes go a long way in making monthly repayments on time.

Personal loans affect your credit score

Any loan or debt is a burden; however, if you are careful, you can repay them faster. The same principle applies to personal loans as well. Experts in debt management say that personal loans are excellent for catering to credit card loans and other urgent expenses like medical bills, car repairs, etc. Make sure you apply for the best loan with an interest rate affordable for your pocket. You need to shop compare different loans from lenders online and make the right choice.

Hard inquiries on your credit report

Note that when you take out a personal loan, you are inviting a hard inquiry on your credit report. Your credit score drops, and this inquiry stays on your report for up to 2 years. If you want to improve your credit score, you should never miss out on any monthly repayments and take good care of your credit. Over time your credit score will improve.

When you are applying for a personal loan, try to take them for a shorter period. For instance, you can apply for a personal loan from 15 days to one month, if possible.

Consult a competent financial advisor if you are taking a personal loan for the first time

Whenever you apply for a personal loan, you must check your credit score. It is prudent to consult a good financial advisor if you have a bad credit score. Some lenders will give you a loan even with poor or bad credit. However, when you are shopping for loans online, ensure you do not fall prey to scams. You should research thoroughly and provide the lender has good track records and credibility in the market. Read online reviews and customer testimonials to get an idea of the background of the lender. Rely on lenders that have been in the market for a couple of years. In this way, you can avoid scams and stay safe.

Personal loans can be a boon when it comes to catering to emergencies. However, manage them smartly, or else you will fall into a cycle of debts. Make sure these loans are repaid in time. Talk to good lenders and understand their terms and conditions thoroughly. Being aware is the first step to make informed choices and stay out of debt!