Compare Personal Loans & Lines of Credit

Are you struggling to pay off your credit card debts when your car suddenly breaks down, or your roof starts to leak? Any unexpected expense at this point will drain you financially. However, there are ways to fix financial emergencies without swiping your credit card at all! You can either opt for a personal loan or choose a line of credit after analyzing whichever is convenient for you.

Manage financial emergencies

Personal loans, as well as lines of credit, are different types of debts. Lenders issue them to both businesses and people. The approval process for both depends upon their intent, and there are factors like the credit rating and history of the borrower that determine their approval. Before you apply for a personal loan or lines of credit, you must understand them fully. You must know how both will impact your credit standing and whether which one will best suit your current needs. With this information, you not only make the right choice, but you save precious time and money too!

An insight into personal loans and lines of credit – what do they mean?

If you need money but don’t have sufficient cash, you could take out a personal loan or a line of credit. However, before comparing the two to know which one of them is the best option for you, let’s first understand what they mean:

- Personal Loan- Personal loans have grown in popularity in the nation. This loan gives you a lump sum of cash. They are an excellent option for people who know how much they need. You borrow this cash upfront and repay the amount over a fixed period. Usually, this time period is 1-5 years with interest. Personal loans are ideal for one-time expenses. For unsecured personal loans, you need no collateral.

- A personal line of credit– This works the best for those who wish to make ongoing purchases. You are granted a maximum amount, and you can borrow against this amount as you need the cash. You do not have to spend what you receive all at once. You can repay with time and only pay interest on the sum that you have borrowed. The interest you pay in a line of credit is higher than a personal loan as the risk levels are higher.

Both personal loans and lines of credit require a credit check. Make sure your credit history is correct and accurate before you apply for them. Note, you should never borrow too much, take as much as you need so that you can repay them fully.

Personal loans versus lines of credit

Personal loans are recommended for-

- Paying off credit card debts

- Making large purchases

- Wedding costs

- Paying off student loans

Lines of credit are ideal for-

- Home improvement projects.

- Protection against overdrafts

- Emergency expenses

- Supplementing irregular income

Being aware of their similarities and differences will help you make an informed choice. You need to understand your current situation clearly to make the correct choice.

Similarities between a personal loan and line of credit –

- Interest needs to be paid for both

- Both require a hard credit check prior approval

- Both affect your credit score

- Baseline requirements for both are similar, like a stable income, a good credit score, and low debt to income ratio.

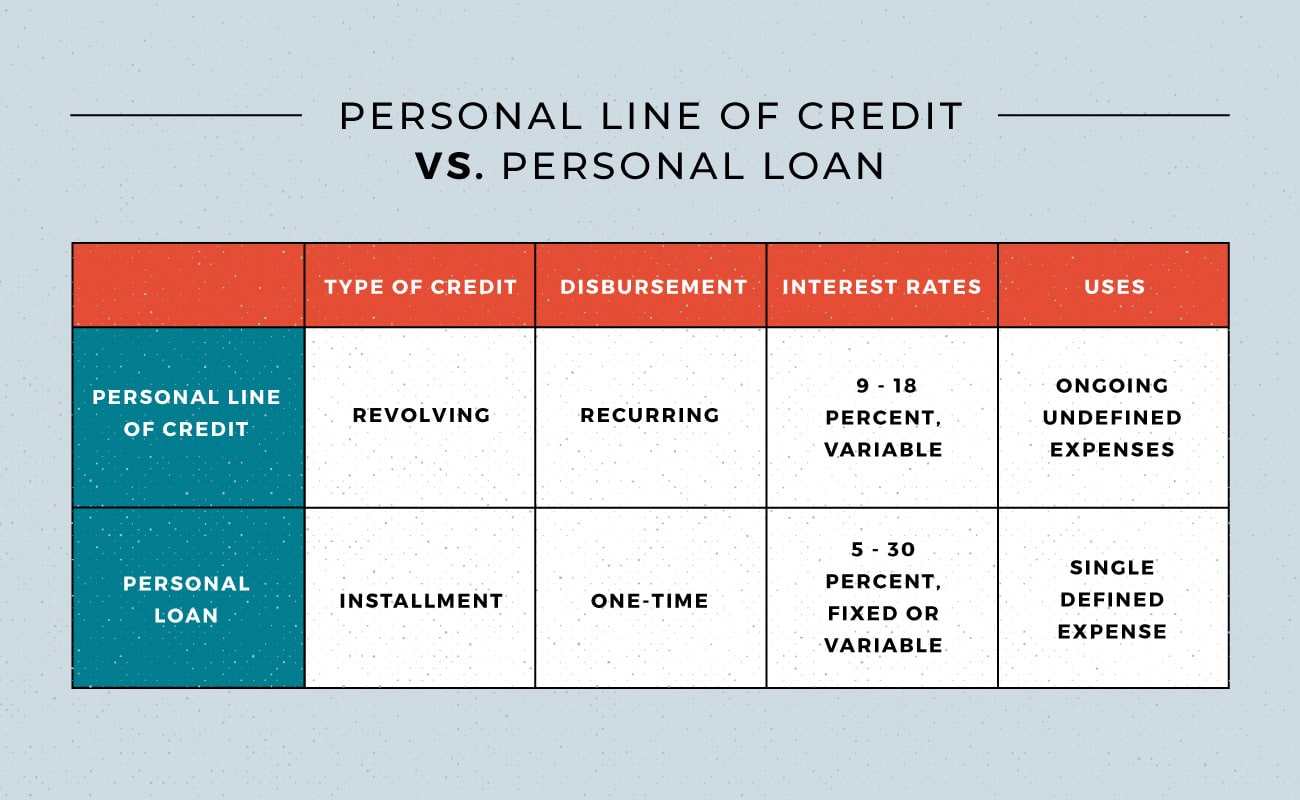

Key differences to note-

- Lines of credit have high-interest rates over personal loans

- Personal loans have fixed interest rates while a line of credit has a variable rate of interest

- The mode of payment for a range of credit is like a credit card as the credit line is “revolving” in nature. You will accumulate interest on the unpaid balance. You can take out as much money as you need. Every month, you are required to pay back a minimum amount like that of a credit card. In personal loans, you get the full payment upfront, and the loan is paid back in a set of monthly installments at specific interest rates over a fixed period.

Personal Loan Vs. Lines of Credit- Making Your Choice

Keep the following points in mind when choosing between personal loans and lines of credit-

- Before you apply for a personal loan or a line of credit, ascertain your levels of need first. Both have their advantages, and you should choose one that best suits the need of the given situation.

- If you are not sure about the exact sum of cash you need, choose a line of credit. It is ideal for ongoing expenses like home repairs, whose total costs are unpredictable. Similar to credit cards, you pay interest on the portion of the credit limit you have used.

- For significant one-time expenses, personal loans are the best choice. If you take an unsecured personal loan, you do not need collateral.

Qualification for lines of credit

If you do not have a good credit score, eligibility is tough. Lenders will approve your application only if you have a good credit standing. If you have bad or poor credit, applying for a personal loan is the best option you have. However, a low credit score means you will pay higher rates of interest.

Again, experts in finance recommend taking personal loans for debt management. They permit you to limit the money you borrow upfront over choosing an open balance of funds to use. Moreover, personal loans give you the predictability of monthly installments you can afford.

What do debt management experts suggest?

Debt management specialists state if you take out a personal loan instead of a line of credit and vice-versa, you will incur more expense. You might pay interest on the money you don’t use, or you may have a very high-interest rate when you could have qualified easily for the other. The trick here is to gather the right information, shop, compare, and decide with time.

They recommend before you apply for a line of credit or a personal loan, you should consider the amount of finance you need for now and the long-run after considering your present credit status. That way, you will make the correct choice with no regrets!